Joint Ventures

Lewis & Partners have been structuring joint venture arrangements for our clients for a very long time – our work in this area originates back to the 1990’s.

Due to our impressive, wide ranging client base of high net worth investors, family trusts, property companies, REIT and institutional investors, we have been able to capitalise on bringing like-minded people together to develop profitable, longstanding working partnerships.

Argo Real Estate with Fusion Group at Foss Park, York

Lewis & Partners encouraged Argo, the dynamic investment manager, to unite with Fusion, who create places and homes that enrich, enhance and inspire those that live in them, on a vibrant mixed used community redevelopment opportunity, on a supermarket, retail warehouse and car park site at Foss Park, York. At the heart of both companies philosophies lies a thoughtful and proactive approach to their projects, with an alignment of knowledge through collaboration. This project is at design phase and aims to create a thriving, high quality sustainable neighbourhood to include communal and accessible green spaces, new memorial gardens, student, co-living, key worker, later living homes and local retail provision.

Argo’s Real Estate Portfolio with Blue Coast Capital

Acting for Blue Coast, the high calibre real estate investor, Lewis & Partners helped them to acquire a significant share holding in Argo’s Property Portfolio of £300M, focusing on the industrial and last mile space, within London and the South East, as well as long income supermarkets. This is seen as the first step in a long-term strategic relationship between the parties.

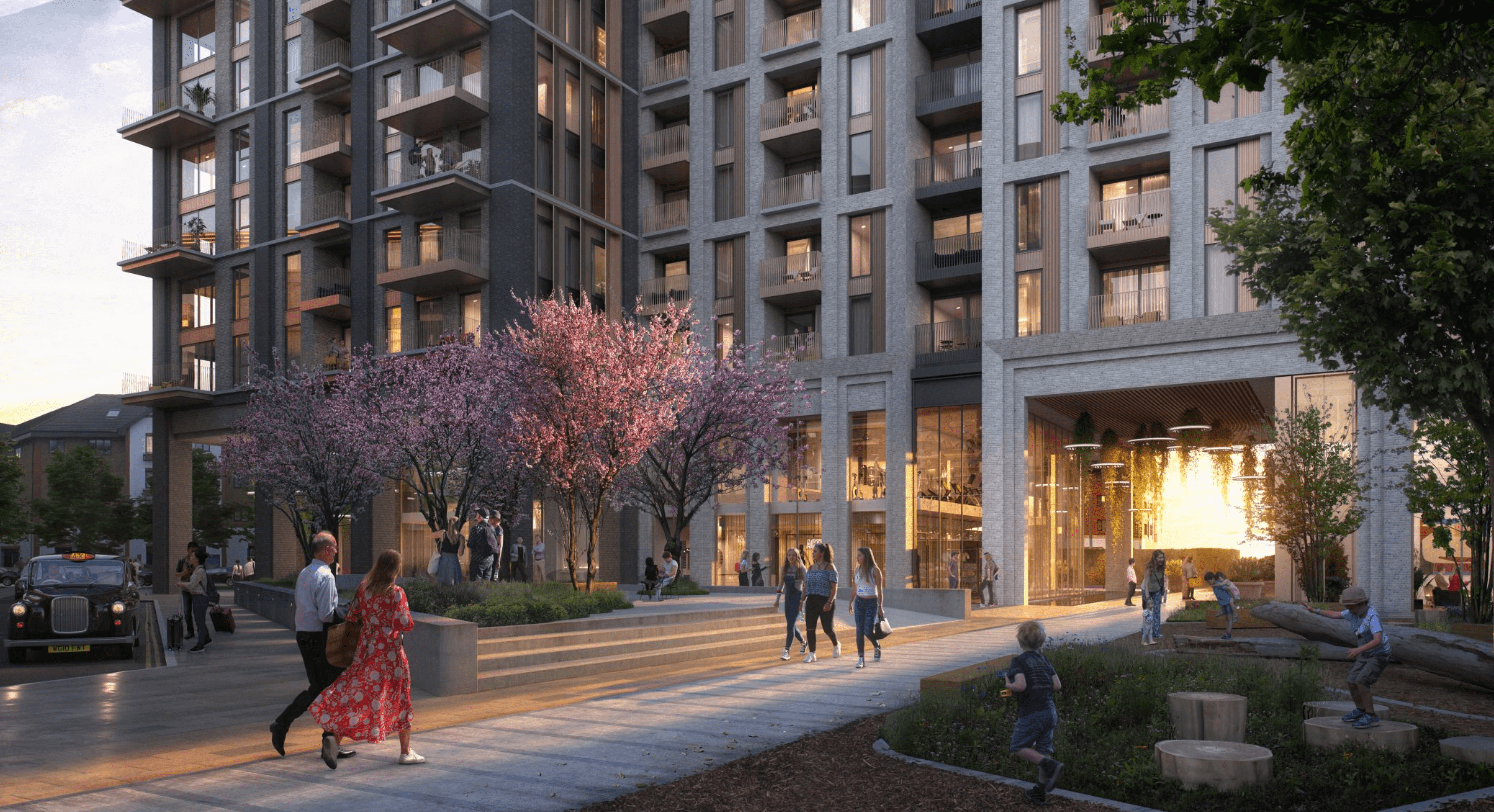

KKR with Regal London

Lewis & Partners was responsible for creating the coalition between Regal London, one of London’s leading residential-led mixed-use developers with KKR, the global investment practice. Their exclusive relationship was created to enable them to co-invest in London-based residential-led mixed use schemes. Both organisations have a culture of innovation and excellence and their first development was Clapham Place, SW9 which completed in Spring 2021. The former tool hire depot became 62 vibrant apartments (one, two, three and four bedrooms) spread over 9 floors, with commercial space on the ground floor. Each apartment boasts access to a concierge service, communal gardens, a gym and a roof terrace.

Tony Khalastchi with various parties

Tony, the private investor, is a very long standing client of Lewis & Partners. Over many years, we have acted on his behalf on a number of high street retail and shopping centre acquisitions in locations like Coventry, York, Bath, Winchester and Norwich, as well as on disposals. He has sought a number of strategic partners, with Lewis & Partners being instrumental in finding the right party. Back in 199o’s, he joined forces with the William Pears Group, the financing and real estate group and he set up a fund with LaSalle in the late 2000’s. Tony has purchased real estate from institutions including CBRE Global Investment Management, M&G and Kames, as well as property companies, such as British Land. Tony has an exemplary track record for concluding successful underwriting transactions and it is testament to his reputation that he often finds himself approached by financial institutions wishing to sell properties discretely off market. Tony is one of the most prolific buyers of retail in the London commercial auction rooms and Lewis & Partners are delighted to be so closely aligned to Tony’s truly inimitable approach to business.

The SoCo

Recognising the recent dominance of the Living sector, Lewis & Partners introduced Matthew Weiner, ex CEO of U+I PLC and now Strategic Advisor to the Crown Estate, to Ben Harshak, bringing their wealth of experience together with the aim to create some of London‘s foremost places. The SoCo is the predominantly London focused, co-living vehicle which has recently acquired sites for development in Cricklewood, Walthamstow and Canada Water. Lewis & Partners have been instrumental in raising capital for the venture from the likes of Blue Coast Capital, Wittington Investments, plus a consortium of high net worth individuals. SoCo’s mission is to create safe, affordable housing for the people that make London great – not just creating homes; but creating communities. Their buildings will include a range of high quality amenity spaces designed to help residents meet each other and become a part of their community ecosysytem. With a host of events, they believe that forming high value connections is key to living a happy life.